Daily Market News - 8th Feb 2022

Are the Banks Gearing Up?

There’s a lot to be said for pivoting and being flexible.

Unless you’ve been aboard a NASA space station the last few months, it’s been exceedingly difficult to ignore the massive outflows from Tech / Growth into the stock market dinosaurs in Energy. Hopefully you’ve done ok out there and managed risk well in the speculative Tech names.

If you missed my piece at the start of the year highlighting the possibility of a Valuation Reset - YOU CAN FIND THAT HERE, the question I’m asking today is… are the banks only just starting to gear up?

I have a few charts I’d like to share.

Regional Banks (KRE)

The chart has been building a base over the last 12 months and if we see outflows from a lot of the over extended Energy names, in a rising rates world, Financials are likely front and centre and a break above $80 would give us a decent risk: reward proposition to be long Regional Banks.

I know what you might be thinking… but Sam, Financials don’t move quickly and they’re boring…. well… tell that to boring old Deutsche Bank.

Deutsche Bank (DB)

I put this premium chart to our clients and members last week and since then it’s already moved 6-7% in a couple of days, with a great chart and strong earnings growth, if we’re above $15… what’s not to like?

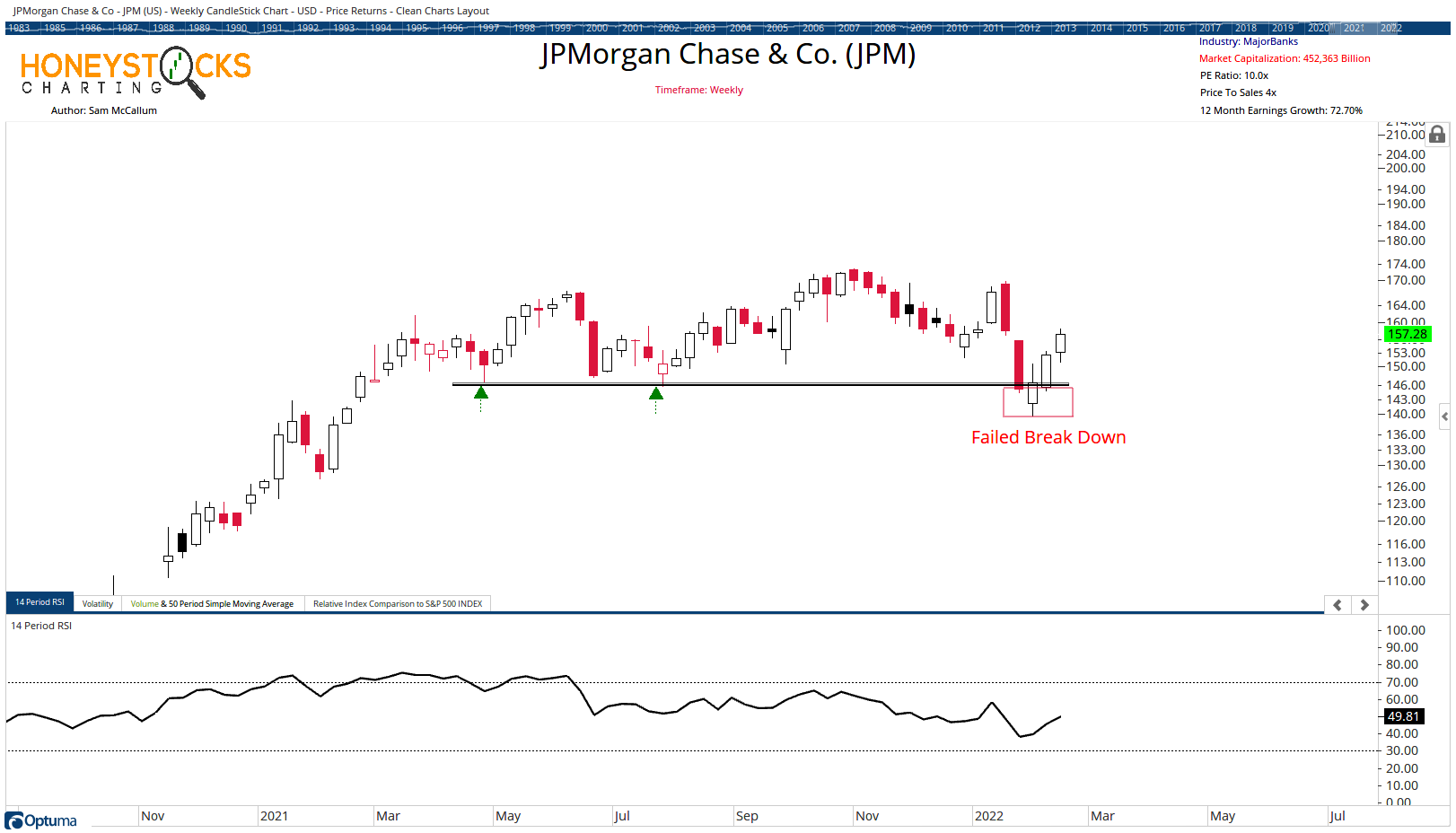

Or how about that Failed Break down in JP Morgan…

J.P Morgan (JPM)

Another premium chart and it looks to be making its way back to former ATH’s around $172.

With a largely positive Earnings out the way, if Financials are going to catch a bid, you’d expect the likes of JPM and GS to be front and centre.

Conclusion

Like the moves we’ve seen since the start of the year in Energy, there’s no reason to think Financials can’t make the same kind of Mick Jagger moves.

There are pockets of strength out there, you just need to be open minded to moving into areas that just haven’t been appealing for many years.

I also laid out 20+ charts last week in case you missed it.

Our Time Stamped Market Calls